how fast does an auto loan build credit

October 10 2018. If you make payments on time your credit score will grow.

What Credit Score Is Needed To Buy A Car Credit Score Credit Repair Business Credit Repair

To build a credit score from scratch you first need to use credit such as by opening and using a credit card or paying back a loan.

. Use these seven strategies to quickly build a rock-solid credit score. Read Expert Reviews Compare The Best Car Loans Options. If youve only had credit cards and are considering your first car loan you may want to know how fast a car loan could raise your FICO credit score.

October 10 2018. Buying a car does help your credit but never buy a. A car loan by itself wont always build credit.

415 64 votes As you make on-time loan payments an auto loan will improve your credit score. Getting a new car loan has two predictable effects on your credit. Getting a secured credit card is one option.

The three main credit bureaus Experian Equifax and TransUnion usually list car loans as installment accounts like mortgages and student loans on your credit report. A car loan by itself wont always build credit. Having a good mix of different types of credit mortgage car loan credit cards etc shows that you can manage multiple types of accounts systems and.

On-time payment history is the most important factor when building credit. Apply To Compare Rates From Multiple Lenders At LendingTree. For instance a car loan contributes to credit utilization and a mix of credit which is all about diversity.

If you want to raise your credit score by 100 points in 30 days you shouldnt rush to buy a car with a loan. Loans reported to credit bureaus as consistently being paid on time can help build creditAn installment loan can help your credit in a big way if you pay as agreed. Get A Self Credit Builder Account Build Positive Payment History.

So does a car loan. The biggest piece of the pie is payment history making up 35 percent of your credit score. See how to boost your credit score by 200 points or even 10 points to get.

Build Credit History with A Self Credit Builder Account - See Our Rates Today. Ad Have Poor Credit. When you take out an auto loan especially.

But if you keep up with your monthly payments an auto loan can definitely help you improve your credit over time. Begin focusing on establishing a good credit history. It will take about six months of credit.

Building credit is a great first step toward financial independence. How much your credit score will increase is determined by your starting point. In short buying a car can be a good way to build your credit score over the life of the loan but its more of a long-term credit building strategy.

The main reason a car loan is a good way to build and improve your credit score is because as you make payments on time you begin to build a positive payment history. If you do your credit score will probably be lower after 30 days. But the amount of time it will take you to.

When you take out an auto loan especially a bad credit car loan you gain the. Working on Building a Positive Credit History. Payment history is essential in credit it makes up 35 percent of your total score.

Credit Mix 10. And now that you understand the role financing a car plays in building credit you have a potential pathway. If you make consistent payments every month over these 180.

Your score will increase as it satisfies all of the factors the contribute to a credit. 1- Improves Your Payment Record. Even one late payment can cause some harm.

15 years 180 months is a long time enough to rectify and rebuild your credit score. Ad Click Now Choose The Ideal Car Loans For You. A car loan lasts over at least 10-15 years.

415 42 votes. If you already have a credit score in the. Based on FICO the most popular credit scoring model you can generate a credit score after six months of reported payment history.

Pay All Your Bills On Time. Ad Get Up to 5 Auto Finance Offers With 1 Form. Click Now Apply Online.

Award Winning Credit Union Advertising Marketing Case Study Mdg Advertising Banks Ads Car Loans Car Loan Ad

How To Get A Car Loan With Bad Credit Forbes Advisor

Becoming Her On Instagram Cash Is King And Credit Is Power You Could Be Leaving So Much On The Table Good Credit Credit Repair Services How To Fix Credit

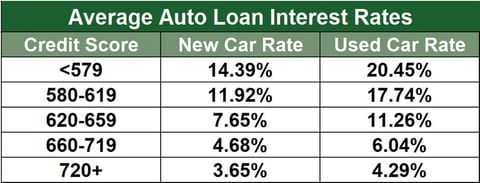

Check Out Average Auto Loan Rates According To Credit Score Roadloans Car Loans Credit Score Loan Rates

How To Pay Off Car Loan Faster Paying Off Car Loan Refinance Car Car Loans

What Credit Score Is Needed To Buy A Car Lendingtree

Image Result For Finance Loan Ad Banners Car Loans Finance Loans Bad Credit

How To Get A Car Loan With Bad Credit Credit Karma

Average Auto Loan Payments What To Expect Bankrate

3 Ways Car Loans Can Go Wrong And How To Avoid Them Car Loans Car Finance Compare Cars

6 Best Bad Credit Car Dealership Loans 2022 Badcredit Org

Auto Loan Rates By Credit Score Experian

9 Easiest Auto Loans To Get 2022 Badcredit Org

Auto Loan Debt Reaches A Record High 1 43 Trillion Experian

How Low Of A Credit Score To Get A Car Improve Credit Good Credit Score Good Credit

Free Car Loan Application Form Car Finance Car Loans Bad Credit Score